1. Open Blogger Interface –> Template –> Create Backup –> Edit HTML –> Proceed

2. Check “Expand Widgets Section”

3. Find this variable by using Ctrl+F

SHOW ANNOUNCEMENT ▼

| Announcement: We will be soon releasing New Section for CA Students and Coupon Codes. Liked Us? Press |

1. Open Blogger Interface –> Template –> Create Backup –> Edit HTML –> Proceed

2. Check “Expand Widgets Section”

3. Find this variable by using Ctrl+F

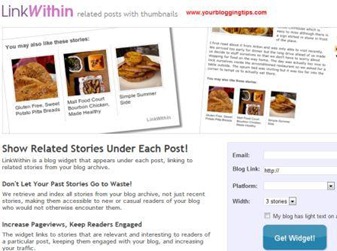

| Related Posts Widget is an important tool to improve page views & keep the interest of our user throughout the website. It certainly helps is increasing the average holding time of a user on your blog/website. Here, I will teach you “How to Create Related Posts Widget” for blogger using Linkwithin service. In my opinion, this is the easiest widget available for blog use & provides tremendous results by providing related posts using its popular engine. |

Follow the steps below to create a wonderful Related Posts Widget for your Blog :

1. Go to http://www.linkwithin.com

| We wear cool suits, we wear shiny Shoes; we’re the Blackberry Boys... Oh yeah, we’re the BlackBerry Boys…. |

| Don't the above lyrics take us back to the days when the world got introduced to the revolutionary device in the market that was meant to be the birthright of the executive high-stature class? Doesn't it make you guys ever wonder about the origin and the rationale behind the name BlackBerry for the RIM’s (Research In Motion) most profitable product? |

| black seeds, the man started exploring varied fruity names and finally settled with BlackBerry because the device was black in colour at that time, and this word is delightful to most ears. |

| Q1. What is 404 Page Not Found Error & Why does it appear ? Ans. 404 Page Error is a broken link error, i.e. a link for which web page/blog is unavailable, deleted, modified. This is a common error which most of us while usual surfing have experienced it. Q2. What is the benefit of setting up 404 Page Not Found Error ? |

| Q. What are Anchor Text Links & what purpose does it serve ? A. Anchor links is a tool which helps user to navigate a webpage from one point to other points. Sometimes, a post/article may be too big which may be inconvenient for the user. So an Index in the beginning can help the user to directly point to different sections of that article. We can create anchor text links by providing two types of effects - 1. Anchor Text Link – Jump Break (Instant Jump) using simple HTML 2. Anchor Text Link – Smooth Scrolling Sliding Effect using JQuery |

The most popular among the web designers, bloggers & surfers is the smooth scrolling effect for comfortable navigation across the web page.

A. Create Anchor Text Link – Jump Break using simple HTML

1. For applying Anchor text link, Go to Source Code of your Blog Post.

2. Locate the TEXT which will point to different sections of your post/article. (It may be your Contents/Index of the Article). For e.g. In my case, I will create Anchor linking on

| A. Create your Facebook LIKE Page. |

| B. Create Facebook Like Box Widget for your Blog |

| Key Budget 2012 Highlights |

| Budget Paper – Key Highlights – sector by sector in bullet points. | |

![Download-Animated-Button[6] Download-Animated-Button[6]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjb08i9oEG036PUNrFCiZq7f4-gWMlxYVMz0ncGpcNRCnDm2tZjlakbUE0vBo3-sNVQfVSD93WF3GWxJzWjgkhZUrhykwlfcaz12IFJ3CQBE7L4sfimyOF5b537GC77JbSxBc7njrX98Uo/?imgmax=800) | Actual Budget Paper presented in Parliament by Hon. Pranab Mukherjee |

A. New Tax Slabs: The Finance minister has increased the tax slabs and given relief to the common man. Especially for the people in the below 10 lakh slab. Greater news for those earning between 8 Lakh and 10 lakh, they move from a slab of 30% to a new slab of 20%. The minimum tax slab has been increased from Rs.180000/- to Rs. 200000/-.

| Tax Slabs Range | % Tax Rate |

| Upto Rs. 200,000 | Exemption |

| Rs. 200,000 to 500,000 | 10% |

| Rs. 500,001 to 10,00,000 | 20% |

| Above Rs. 10,00,001 | 30% |

B. Exemption to Homeowners: The homeowners of apartments can enjoy tax exemption of Rs. 5000/. Spent on maintenance. This exemption level has been increased from Rs.3000/- to Rs. 5000/-.

C. Capital Gains:

D. Health Exemption: Exemption permitted upto Rs. 5,000/- for expenses incurred on Preventive Health Check up

E. Income from Other Sources: Exemption of Rs. 10,000 on interest earned from Savings Bank deposits for people with income upto Rs 5 Lakh

F. Invest in Equity and get tax exemption - Rajiv Gandhi Equity Saving Scheme will get 50% income tax deduction. This will be applicable only to the New Retail Investors investing directly into equity up to Rs. 50,000/, with a lock in period of three years. The annual income of the investor should be less than Rs. 10,00,000/-. Changes have been made in the IPO guidelines in order to ensure the participation from small towns.

|

Budget 2012 Expectations – Source:TOI

This year and the previous one - it's been different: The Union budget will be presented on 16th March, 2012. Historically, with the economy running almost on auto pilot, the budget has always taken a back seat when it comes to impact on markets. However, the macro backdrop is certainly different this year and the previous one. This year's budget assumes particular importance due to the ongoing macroeconomic problems within the domestic economy.

Frugal, reformist and pro-growth budget?: Given the investment-led slowdown in the economy, with a need for fiscal pump-priming on one hand, and steadily deteriorating public finances on the other, the budget needs to be frugal, reformist and pro-growth at the same time. Not an easy task, given the (populist) demands of the realpolitik. Moreover, the recent assembly election results in UP, Punjab, Uttarakhand, Goa and Manipur have left the current UPA-2 government at the centre on a back foot. The budget would thus reveal Congress' response and the way forward for the next 18 months - whether it turns more 'populist' or muddles along.

Two most important aspects that are key to the FY13 budget are:

Balancing growth with deteriorating finances: The government is walking the tightrope with growth concerns on one hand, and its deteriorating finances on the other. What makes it trickier is the lack of headroom this government has, to provide a fiscal boost to support growth, like the way it did back in 2008-09. On the other hand, it needs to announce enough policy measures to address the visible slowdown in economic activity. Though the Union Budget is not a platform to announce 'non-budgetary' reforms, the government can use the opportunity to do so, as it has in the past, in order to mitigate the prevailing negative sentiment. However, the key need of the hour is for provisions enabling a revival in investment activity in the economy.

|

| Google Sniper 2.0 Review will help us understand whether the product is Google Sniper 2.0 SCAM or boon to Internet Marketing community. It will also help us to decide whether Google Sniper is going to change your life & provide you necessary tools to make money from Google. Click Here to get your Google Sniper 2.0 copy |

We will discuss about the following segments in brief such as -

Let us understand in quick & easy language about above mentioned topics -

Q1. What is Internet Marketing ?

Ans. Internet Marketing is similar to marketing of any usual product say books, electronics, gadgets, physical products for e.g. toys, sewing machines etc. or any product which can be sold in the market. The only difference is that such products are marketed online using various online promotional activities. The people who works as an internet marketer is also known as an Affiliate. This type of marketing is also popularly known as Affiliate Marketing. The Affiliate receives commission per sale as decided.

The Affiliate receives commission whenever a buyer makes a purchase through his (affiliate) link or his (affiliate) website. So the ultimate purpose is to get buyers (popularly known as “traffic”) to their website & motivate those buyers to purchase products through their affiliate links. This is the core concept of making money from Internet Marketing.

Popular marketplace wherein Affiliates/Internet Marketers obtain affiliate link & commission per sale details are ClickBank, Amazon, Commission Junction (Physical products), LinkShare, Google Affiliate networks, ShareASale, eBay, RevenueWire etc.

Q2. Who is eligible for such type of marketing ?